On March, 17, 2015 in London. SES satellite company presented the results of TV market monitoring in different regions, and published detailed research on Ukraine. MediaSat offers its readers to get acquainted with its results.

According to received data, the satellite TV’s share decreased slightly from 4,49 million of households in 2013 to 4,33 million in 2014. The same can be said about terrestrial TV with its share’s decreasing from 5,96 to 5,58 million. The cable TV and IPTV showed an insignificant growth (by 0,35 and 0,08 million respectively).

As for the above picture, it’s worth specifying that DTH refers to households with individual dishes, and SMATV-CH refers to collective dishes for satellite receiving.

The data differs in some way from that published by Ukrainian companies Such differences can be explained by distinct approaches to data collection and the complexity of research in view of the current political situation. Anatoliy Frolenkov, managing partner of E&C consulting company, said that the final figures were obtained by inquiring market players like operators, as well as considering data from official sources (like State Statistics Service, National Commission for the State Regulation of Communications and Informatization and others).

Laurence Cribier, SES Senior Marketing Coordinator, specifies that the obtained figures are approximate enough, as in 2014 it was impossible to conduct full-valued surveys in some regions (Crimea and ATO zone). The index evolution was also affected by changes in research methodology: in 2012 SES started contracting research of GFK Ukraine in all the segments of TV market, and not in part as it was before, – responds M-me. Cribier to MediaSat reporter’s question.

As for the end of 2014 the TV market in Europe is divided as follows:

As we can see, in Ukraine the shares of cable TV (38%) and the terrestrial TV (34%) are significantly higher than the European average rates (each segment accounts 27%). While the leading receiving mode in Europe is satellite TV (35%), its share in Ukraine reaches just 27%. The largest gap is observed in IPTV segment (information on ОТТ and internet TV is not represented in the SES research): 1% in Ukraine vs 11% in Europe. For consolation, however, in Ghana one can’t even speak about cable television and even less so about IPTV: 69% of households watch terrestrial television, and 31% watch the satellite one.

It’s worth mentioning that the division by TV receiving modes differs significantly in distinct European countries. When the market in Germany is shared in fact by satellite (47%) and cable (44 %) operators, and in the Great Britain it is shared by satellite (44%) and terrestrial (32%) ones, so in France the dominant technology is IPTV (40 %), and the cable television is out of favour (8%). The situation in Spain is quite different: the undisputed leader became the terrestrial signal transmitting mode (67 %). And in Ireland 67% of households prefer the satellite TV. The reason for such differences became many factors, as the TV market of each country experienced its own individual development.

Unfortunately Ukraine remains far behind the European rates not only by IPTV prevalence. In Ukraine and Greece the penetration rates of digital TV remain the lowest ones.

While in Europe …

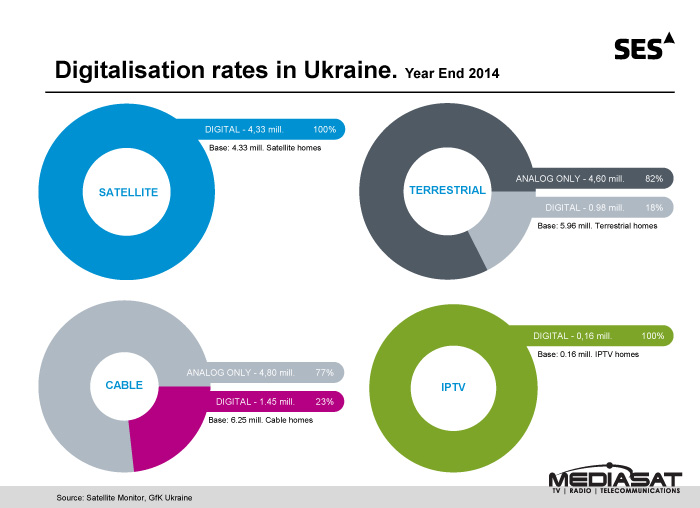

Here one may trace the evolution of digital TV penetration in Ukraine.

The satellite signal in Ukraine is fully transmitted in a digital standard, the digitalization of cable TV is far behind and it reaches just 23% of households. In Europe 67% of cable TV viewers watch it in a digital quality. As for the digital terrestrial TV, one can see that in 2013 it was set in motion, but compared with the European ones (89%) the rate still remains very low at 18%, according to SES company’s information. The reasons for such situation lie in the government regulation mistakes and corruption schemes of the terrestrial digital television’s provider. We shall recall that Zeonbud became the winner of the all-country digitalization tender under questionable circumstances. The operator’s representatives declared 95% of population has the opportunity to watch digital terrestrial television, and if we may trust them, we have a higher digitalization level than the European one, which is very doubtful. The field experiments and expert opinions, however, prove that the actual coverage is far from the declared one. Looking at the state digitalization policy the cable operators aren’t in a hurry to switch over to a new broadcasting standard.

Things are no better with HD-channels, which are quite poorly represented in Ukraine. Just above 1 million of households have access to them, and they are mainly satellite TV viewers (0,72 million). Lauren

A survey was conducted in European countries on how the viewers were familiar with Ultra HD television. That survey wasn’t conducted in Ukraine, which is demonstrative in itself.

As for SES satellite operator’s presence in Ukraine, a positive evolution is also observed. Other companies’ data can be found in MediaSat’s material.

Despite the sad notes being difficult to avoid comparing rates of TV market in Ukraine with the Western Europe’s ones, there is still cause for optimism. Over 16 million households, emerging and requiring changes market, available niches – these are the factors that under the stabilization of political situation can become the basis of successful business development in Ukraine and can offer even more opportunities than may be expected in other countries.