It was the third time when Mediasat was a mediapartner of TelcoTrends conference in Latvia (Riga, August, 10-14). The main trend of Telco Trends – 2015 was a single European digital market. Meanwhile previous conferences were more about situations in the market and digitalization process in different countries, the changes seem not to be occasional.

Digital Europe

Edmunds Belskis from the Ministry of Transport of the Republic of Latvia told about the Program “Digital Europe” and going towards a single digital market.

Digital agenda for Europe is the following:

– by 2013: broadband access for all

-by 2020: access for all to much higher internet speeds (30 Mbps or above)

– by 2020: 50% or more of European households with internet connections above 100 Mbps.

The whole European roaming and net neutrality are the points of the plan.

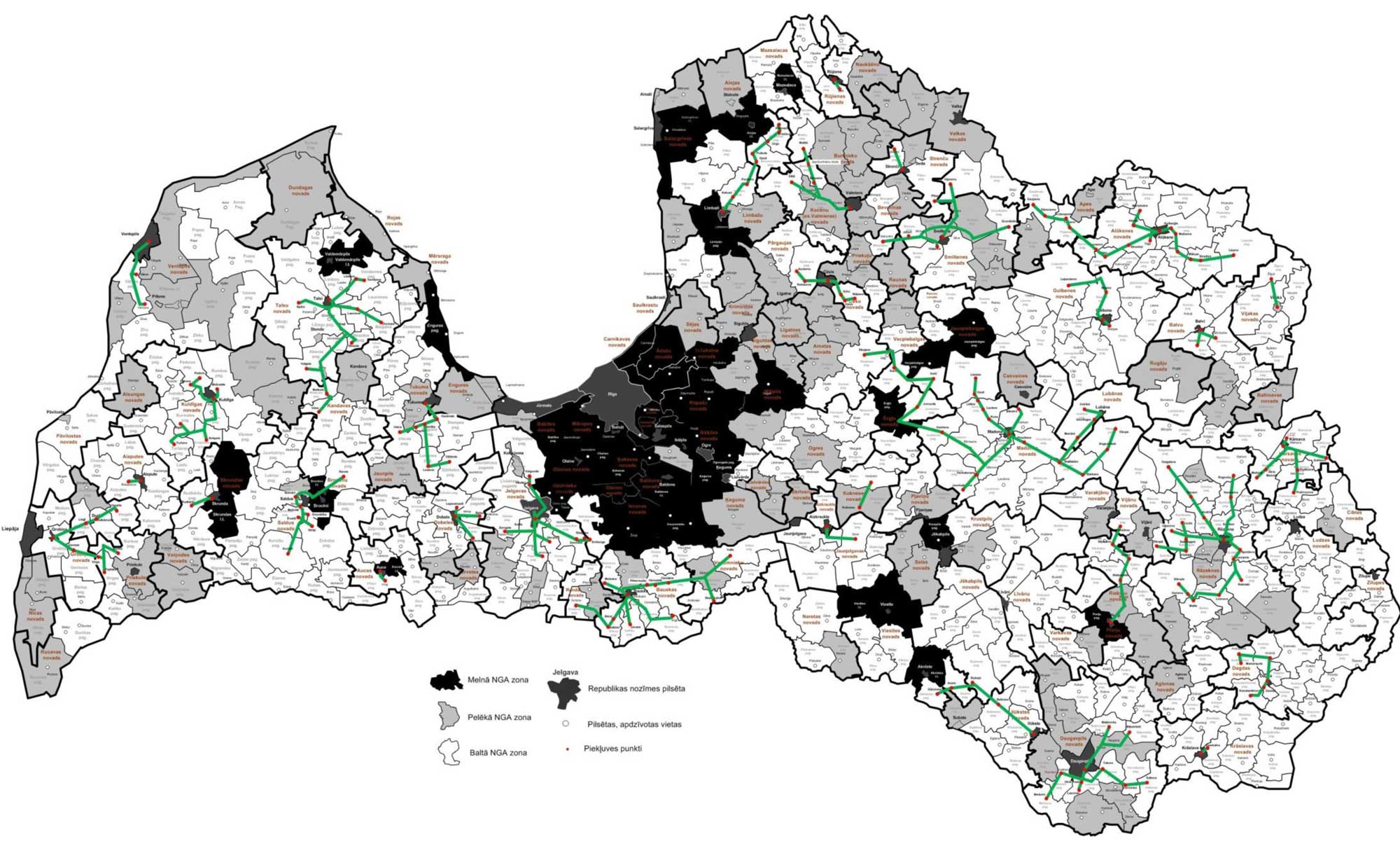

“The project supports the development of fiber backhaul infrastructure for wholesale broadband services in rural areas which are currently not served”, promises Mr. Belskis.

Before the middle of 2015 177access points and about 1870 km of optical network were built. Until 2020 300 access points and about 3 000 km of optical network is planned to be built.

Among problems identified on digital market Mr. Belskis mentioned:

– Modernizing copyright, as user want to get access to their content being abroad.

– Only 59% of Europeans can get access to 4G, dropping to 15% in rural areas.

– Take up of fast broadband is low: only 22.5% of all subscriptions are fast ones (above 30Mbps)

Andrejs Dombrovskis, Deputy Director, Electronic Communications and Post (SPRK) detalized situation on Latvian market and told about Eastern Europe cooperation.

The idea of a single digital market seems to be quite serious, EU authorities are engaged in its improvement as well as such organization as BEREC (The Body of European Regulators for Electronic Communications) which is not an EU agency, but a body sui generis.

The monopoly Latvian operator Lattelecom announced its new direction towards EU and global market, avoiding overregulation and equal opportunities attract the company. Mediasat has written about fast and successful experience of digitalization in Latvia due to Lattelecom. The company provides broadband, TV and data transferring solutions and is proud of its high-speed internet. They say Riga is the Wi-Fi capital of Europe due to Lattelecom. I can confirm that this is true. Wi-Fi access is almost everywhere in the city center, which makes a good advantage to Riga in front of other European cities, where tourists have a lot of troubles trying to get to internet access. Toms Meisitis, Director of the Law Department of Lattelecom, stated that one of the main tendencies for European operators would be provision of full range of services (broadband, TV, mobile internet, voice and data transferring services, etc.)

Satellite news

Usually satellite sessions at the conferences are not the most popular, but this time was an exception. Live discussion between two global operators, SES and Eutelsat, turned out to be quite interesting.

SES, the general sponsor of Telco Trends, presented its Ultra HD solution, which became the main point of discussion. The representatives of the competitor operator Eutelsat questioned that the service had real chance of being popular. Onno Zonneveld, Head of representative Office in Ukraine, Russia & CIS, mentioned that it wasn’t supposed to be mass market so far. “Ultra HD video refers to Premium segment and it will be a kind of exclusive luxury service of high quality. If there is a new technology it will be developed sooner or later, SES decided to be a pioneer in Ultra HD”, Mr. Zonneveld said.

Nils Filip Abrahamsson, Sales Manager Nordic, Baltic & Eastern Europe, detailed the advantages of the Ultra HD standard.

Why is it better?

– Progressive artifacts look better than interlacing;

– Color nuances are better, there is no color banding in Ultra HD;

– Ultra HD provides brighter images, which increase contrast, details become more visible;

– High Dynamic Range (HDR) – the range between the darkest and brightest images – is expanding from 100 -300 cd/m2 (nits) for today till 1000 – 2000 cd/m2 (nits) so far.

– Wider Color Gamut can show 75% of colors instead of usual 35%

– Higher Frame Rates are available, instead of 30 FPS earlier, 50-60 FPS now, 100-200 FPS is possible;

– Smoother movement can be achieved.

The prognosis for Ultra HD is quite optimistic according to SES data, there are reasons for this. Mr. Abrahamsson insists it can’t be compared with 3D, which got a good start but bad end, the question “when” suits better than “if” talking about Ultra HD.

Users buy more and more 4K TV, this means they will be interested in 4K content. Here is the prognosis:

The next world trend is buying larger TV screens, according to Futuresource research: 60% of respondents say they are going to have their next TV set larger than previous one. Larger screen demands better standard – Ultra HD.

The way of Ultra HD growth most of all will remind HD channels starting on DTH platforms, then their coming to Cable TV. The leaders are North America and East Asia, but the tendencies are the same for all regions. There is not only test broadcasting of Ultra HD by SES or Eutelsat, but commercial broadcasting is also available in Japan, South Korea and India. It is expected to be around 430 Ultra HD channels by 2024 due to investments in developing markets.

Ultra HD channels are the driver for DTH platforms to compete with growing OTT and increasing their ARPU. Providing live TV and high quality channels focusing on sports, movies on demand content will help DTH platforms to resist to strong OTT and IPTV positions especially in Western Europe.

Mr. Abrahamsson talked about role of SES in Ultra HD ecosystem: “SES has been facilitating the technical innovation to prepare Ultra HD rollout in 2016 and pioneered the first Ultra HD satellite transmission in new HEVC standard”. We shall recall, Mediasat wrote about SES is the first to broadcast demo Ultra HD channels in Europe and is increasing the number of channels.

Michael Sandler, Business Development manager in Russia, informed about SES achievements in Europe and detailed the differences in the markets of European countries. Mediasat wrote about the latest SES data in different European countries.

Apostolos Triantafyllou, Senior Vice-President of Sales for CE Europe & Eurasia, talked about Eutelsat company and research they had made in Baltic countries. The operator serves the Baltics via three positions: 13° E, 9° E and 36° E, which provide services for 178 thousands TV homes while indirect reach is 1.2 million TV homes or 75 % of the cable and IPTV markets. Talking about readiness for HD, on average, 30 % of users are equipped with an HDTV set and 16 % of non equipped homes declare purchasing intention within the next 12 months. “Out of 806 thousands households owning an HD screen, 28 % subscribed to an HD offer; 13 % of non – subscribed homes intend to subscribe within the next 12 months. Overall 64 % of respondents in Baltics are aware of UHD and/or have seen a demo 5 – 8 % of non-DTH homes intend to buy a satellite dish within the next 12 months”, Mr. Triantafyllou informed.

Also the Eutelsat company presented an equipment for triple-play service and dichroic sub-reflector for TV reception from Eutelsat 9B. Mr. Triantafyllou payed attention on the advantages of this position for the Baltics.

Fighting piracy

The aspects of fighting against piracy were discussed in the course of several sessions within the conference. The problem is really global and its discussion was important for the most of audience, and there is a quite relevant slogan: Operators of the world, unite!

The company Irdeto (Andrei Silanchev) presented very interesting results of researching piracy activities. Along with the growing popularity of OTT the piracy has been also growing.

The right holders and legal players can not but alarm the increasing consumer interest in OTT receivers providing pirated content. According to the study, the requests to Google for such receivers started increasing in 2013, and the requests for unsecured devices exceeded the requests for legal devices at the end of 2013. The peak of requests falls on the end of the year when increasing buying activity.

After analyzing prices of services provided by pirates, the analysts managed defining the revenues of illegal players, and they are considerable.

The market price of an OTT device with subscription ranges from $50.00 to $1,602.74, and the average one is $387.49.

Speaking about the situation in Ukraine, Konstantin Gritsak, Chairman of the Telecommunication Chamber of Ukraine, paid special attention to the problem of piracy:

“According to our estimates, the illegal platforms are used by millions of subscribers, and our common task is to bring them out and make them consumers of our services.

The legal market participants are constantly talking about the need in doing business honestly, but in fact we experience dumping wars and under-reporting, originated mainly due to the lack of practical steps of the Government and right holders in combating piracy”.

During the panel discussion the representatives of different countries shared their experience in this field.

Vyacheslav Vasilevsky, the CEO at IP MediaGroup, told about the problems of piracy in Ukraine and ways of their solution. According to him, an economic dispute compared to sueing appears more effective and less traumatic way to fight against organizations caught in piracy. Juozas Jurelionis (Director of the Lithuanian Cable TV Association) said that 10% of Lithuanian residents enjoyed pirated services and 20% of citizens were ready for doing it. Edmunds Belskis (Director of the Communications Department of the Ministry of Transport of the Republic of Latvia) pointed out that 25% of Latvian residents had available both legal and illegal services to enjoy simultaneously. In Ukrainian terms, the percentage is too insignificant, but, nevertheless, the problem is quite serious. During the discussion there were proposals to ban the manufacture and sales of unsecured receivers and those distributing pirated content. It is interesting that during the discussion the Baltic representatives focused on the role of the Government and legislative regulation, and the Ukrainian market players also referred to the need in changing laws, but the most of their proposals regarded the self-regulation, so they were rather how to proceed in that situation for a particular legal player.

The local markets

In the framework of Telco Trends the representatives of different countries shared their experience in developing telecommunications and digitization. In our previous stories we introduced the reader to the situation on the Baltic market.

This year, the National Telecommunication Association of Kazakhstan presented the progress in implementing digitalization. From 2012 to 2014 Kazakhstan arranged digital terrestrial TV broadcasting at 336 Radio and TV stations (RTS), which already covered 72% of the population. Especially active was 2014:

– 2012 – 5 RTS (Astana, Almaty, Karaganda, Zhezkazgan, Zhanaozen);

– 2013 – 34 RTS (Administrative centers, Mangystau Region);

– 2014 – 297 RTS (Almaty Region, Zhambyl Region, East Kazakhstan Region, South Kazakhstan Region).

By 2019 it is scheduled as follows:

95% of the population (6900 localities) to cover and 827 RTS to build.

It is worth noting that the development of telecommunications in Kazakhstan is quite fast in general.

……..

The conference was marked not only with interesting reports and information exchange, but with communication on unofficial meetings and events. The most amazing one, as Telco Trends participants told, was SES cocktail party on the Baltic seashore.