On February 16-20, 2017, the Ukrainian telecom market players gathered again to discuss the latest trends of the industry at TIM: Broadband, which was held in Truskavets this time.

The discussion began with an “exchange of impressions” from transiting to commercial relations between media groups and providers, which Mediasat featured many times.

Fedor Grechaninov, StarLigtMedia: “In general, we are satisfied with the results as of January 1. There still remain two regions where we would like to improve the situation. I hope common sense will prevail. Operators have lost a lot of subscribers in Odessa”.

Vladimir Masarik, “Thorsat”: “There are a couple of companies we have not agreed with, but in general the situation is just fine. We will think over the analog cut-off, i.e. which signal propagation technology to invest in”.

Yaroslav Pakholchuk, “1+1 Media”: “We signed contracts with more than 3 million 650 thousand subscribers. It proves the dialogue to produce results”.

Cable operators may not be entirely satisfied with the situation, but most of them signed contracts with media groups.

Alexander Fedienko, InAU: “Previously, television was subsidized for Internet providers, while the main income item is the Internet. Now, it is possible to prepare paid packages. But the media groups did everything unilaterally, one-sidedly”.

The event participants discussed the T2 public service video, the media group, in response to the question of the moderator and media expert Alexander Glushchenko, said that they did not rule out the option of filming another joint video.

The transition of media groups and cable operators to commercial relations is a tectonic shift on the market, and the first step towards building a new model of the pay-TV market. During the next panel, organized by the Mediasat, the participants discussed the “agenda” of cutting off analog TV and encoding satellite signal.

The scheduled day 30 June 2017 for the analog cut-off drew objections of the “1+1 Media” and “Inter Media Group”. These holdings even wrote an official appeal to postpone the analog cut-off, but the National Broadcasting Council did not find their arguments reasonable.

Andrei Malchevskiy, “1+1 Media”: “1 million 200 thousand people are low-income and watch the analog TV. In addition to the distributed set-top boxes, there are still required about 700 thousand more devices to provide the population with”. Yaroslav Pakholchuk pointed out that in that situation they still forgot about the monopoly position of “Zeonbud”. He also believes that it is impossible to cut off the analog TV in the areas lacking digital coverage.

Vladimir Masarik also spoke in favor of postponing cut-off and talked about the measurements made in cooperation with the “1+1 Media”.

The member of the National Broadcasting Council Oleg Chernish remarked that in the East, the coverage was just 40-60%. “The project provides for the analog cut-off except for border areas, but the territory is not clearly marked. It is necessary to find out whether the media groups agree on expanding the network of one single multiplex. This could be Zeonbud or the multiplex built by the Broadcasting Radiocommunications and Television Concern (BRT). In case of the analog cut-off, the BRT will become unprofitable, and it, in turn, can be acquired by “Zeonbud” or someone else. The BRT applied for 411 localities, while Zeonbud just for 166. There will be some channels of the “1+1 Media”, public service channels, and the Inter Group to be followed by others”.

At that, Fedor Grechaninov remarked that the Concern had more than enough time to build a multiplex, and there was no good postponing cut-off because of the Concern and shifting its problems to others. He believes it urgent to cut off the analog in those areas where the coverage reaches at least 90%. “This will have the greatest impact on pay-TV”.

Apostolos Triantafyllou, Eutelsat: “If we compare the Ukrainian market with Europe, what is difficult to do, it immediately catches the eye that DTH does not work here. Like any other European country, Ukraine has media groups. In Italy, for example, cable television has never been developed a lot. The audience that was unable to go to the digital terrestrial TV went to the satellite one. Some viewers preferred a free distribution model, and others were encoded. After the analog cut-off, the volume of the satellite market increased by several million subscribers, while the rest ones went to DTT. There is no saying that Italy evidenced transiting to market relations (they were before indeed), this is about channels’ opting for their own model. In Ukraine, some operators will keep on DTT (Zeonbud), and some will go to the satellite. But the audience will not stop watching TV. At the same time, I can see no reason to give up cutting off analog signal. The only thing that can be done for the market development is to encode the satellite signal and this is the driver for revenue growth. I can hear that Zeonbud is not ready to cut off the analog, since it requires a satellite. The content can be diversified. Once the signal encoded, the revenue will double or even triple”.

In the autumn of 2016, Fedor Grechaninov announced a possible date of satellite coding, and it was January-February 2018. He claims that this date is still relevant, if the analog is cut off on 30 June 2017: “It is suitable to encode satellite not earlier than six months after the analog cut-off”.

Oleg Chernysh supports encoding on the one hand, but on the other hand he is not sure that people would immediately switch to commercial platforms. Vladimir Masarik drew attention to the fact that it was necessary to get prepared for encoding, i.e. to import equipment and prepare people.

Yaroslav Pakholchuk also calls for caution, so it is required to assess the real digital coverage, since the channels of neighboring countries are free to access. “We will conduct a study to find out how many viewers will remain on the free satellite TV. Roughly 7 million households or 20 million residents should change their signal reception mode. The full process should take about 1.5 years, according to my personal estimates”.

And the Internet industry believes that the future is with IP.

Mikhail Polovinka, UA-IX: “I agree with the Apostolos Triantafyllou that all technologies will develop. For the time being, we should keep an eye for smartphones and IP access. Satellite encoding is a trigger for the development of IP-providers. The localities exceeding 5 thousand residents are 100% covered with the Internet, and those with less than 5 thousand has a 70% coverage, while the localities not exceeding 1 thousand residents will get a 100% coverage a year later. So, the Internet is the thing of the future”.

The company “Kosmonova” (Igor Lutsenko) told about the advantages of IP content transmission (cost, convenient infrastructure, ability to create archives and delayed viewing, replacement of ad units, etc.) and shortcomings (Internet interruptions are still possible).

During the panel “TIM Broadband: Business and Investment”, the experts discussed whether there was any use to the Ukrainian telecom industry in waiting for investment inflow.

Andrey Kolodyuk, Chairman of the Supervisory Board at UVCA, considers the most promising projects dealing with the Internet, security, media projects, animation, video streaming (four OTT services in Russia showed their profitability), as well as outsourcing goes on developing. Mr. Kolodyuk is confident that the investment would be channeled only to large players. “The investors should be sought for in Ukraine. I receive calls from other markets’ players, asking what it is better to invest in. For example, from the agricultural sector and food companies, which look at businesses generating steady income, like the telecom industry, for instance. The best investor is your customer”.

Maxim Smelyanets remarked that “Foreign companies do not invest in IT, but only in exporting labor forces and projects. Money is in Dubai, Israel, China. We have good OTT solutions, which are unreal to monetize and can only be exported. For 5-6 years, as far as I know, no Ukrainian telecom company has been bought from abroad in terms of large deals. “Ukrainian investors turn out more preferable because they are not afraid of our companies, like the foreign ones are.

Maxim Kravchuk, “Triolan”, agreed that it was not worth expecting for foreign companies’ purchases. The chances for investment depend on the company’s performance, growth rate, etc. The investment in IT companies would produce good results, as Mr. Kravchuk believes.

Natalia Tikhovskaya, Ukrsotsbank, spoke about the landing terms: “It is required to provide investors with comfortable terms. This can be not only financial assets, but also business investment like equipment supplies, etc”.

The experts, however, are skeptical about lending. Sergei Shishkin, “Fregat”: “If we take loans, then only the short-term ones, we try our best to forgo them”. Maxim Smelyanets also does not advise taking loans because the growth rate is eaten up by inflation and devaluation.

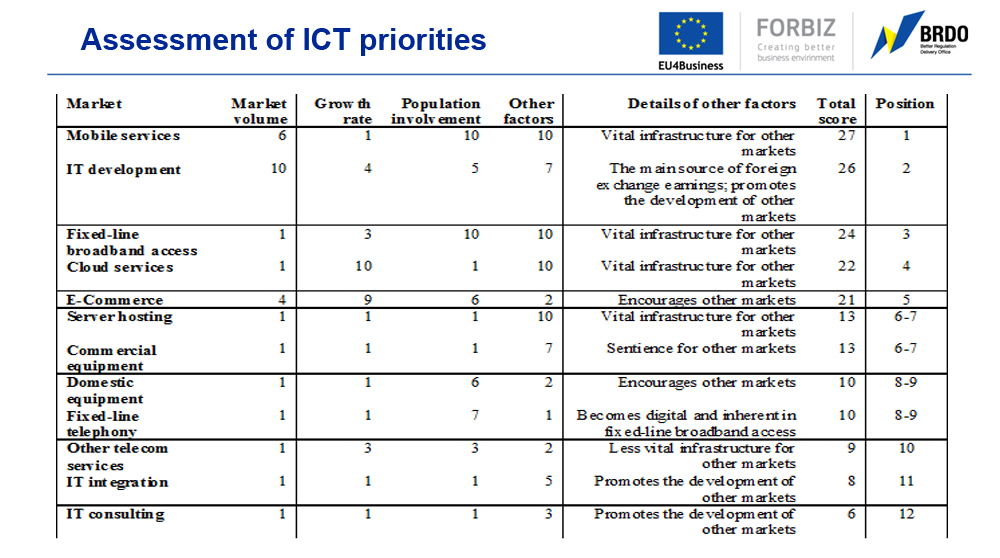

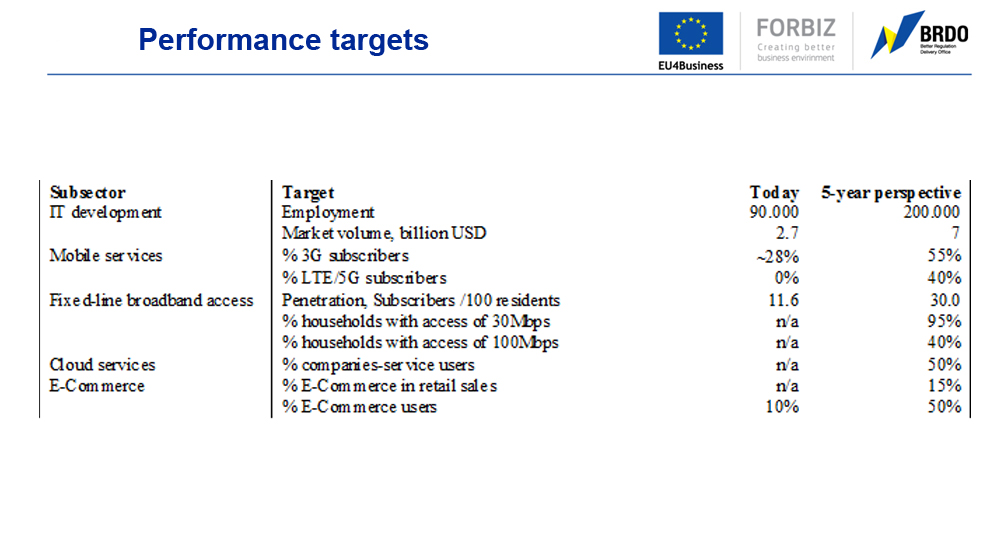

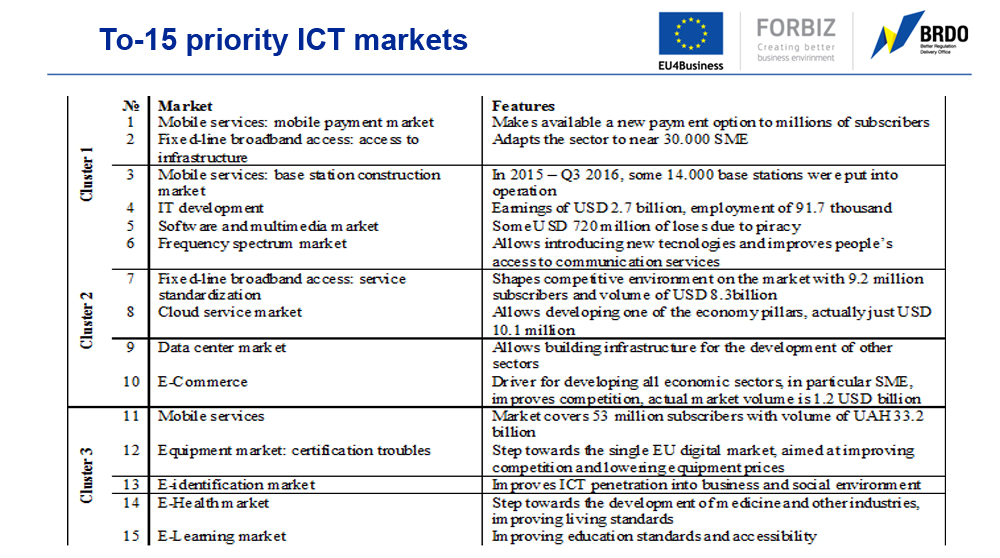

Alexander Shelest, IT and Telecom markets analyst at Better Regulation Delivery Office (BRDO), talked about how to analyze the investment attractiveness of a company using NRI, an index describing the development level of Information and Communication Tecnologies (ICT) in the country. “It is important to emphasize that 24 out of 54 calculation indicators are subject to the government impact”. The ICT market has been growing, and its share is already 3.32% in terms of value added in Ukraine.

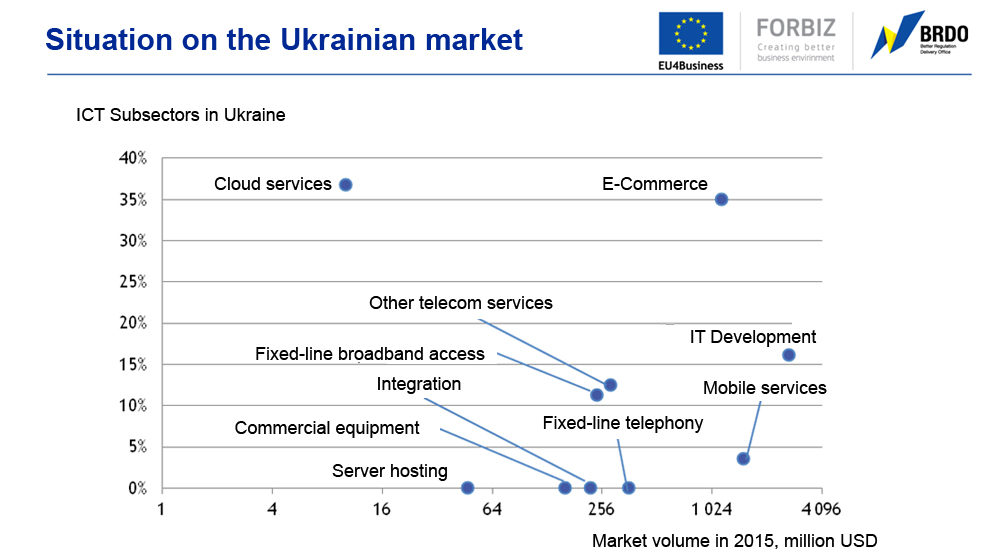

The largest markets in Ukraine are as follows:

- IT development (USD 2.7 billion)

- Mobile services (USD 1.5 billion)

- E-Commerce (USD 1.2 billion)

The fastest growing markets are as follows:

- Cloud tecnologies –37%

- E-Commerce – 35%

- Development – 16%

The smallest volume is shown by the cloud service market (USD 10 million) and the server hosting one (USD 47 million), but they constitute an infrastructure for all other markets.

During the strategic panel “My Business in 2017: “Literacy and Team Idea Generation” Andrey Pastukhov and Anatoly Frolenkov from Expert & Consulting drew attention to the main challenges of 2017. This is a saturation of the Internet providers market, ARPU growth, as well as risks of selling (or not selling) companies. Andrey Pastukhov spoke about the tools for structuring business models, assessing company’s performance and making adequate decisions.

Sergei Kubanskiy, Undernet, shared the secrets of sales success. The retail techniques are quite relevant for providers, for example, it should be borne in mind that 90% of goods are sold during promo offers, but they should be run in the way to avoid dumping. “When we connect a customer, we present him a Ukrainian flag or a connection scheme with the layout of apartments and all specifications that emphasize our professional competence. Or other promo events to opt for subject to the customer”.

Nikolai Kozak, “Telesystems of Ukraine”, drew attention to the importance of retaining subscribers. “There is no secret that previously we went to a location without Internet and connected subscribers, exercising the “the lord’s night”. Now, we have changed the strategy, because there is no sense in subscribers who jump from one provider to another, since we are in need of stability”.

During the panel “Government and Business”, the member of the National Broadcasting Council Oleg Chernysh spoke about plans to ease licensing for providers, in particular regarding the list of distributed channels. Providers discussed the progress achieved and articulated pending problems.

The best one also turned out the informal section of TIM: Broadband-2017, when the conference participants went on informal socializing at parties, excursions and spa.