Most of the video services’ revenues were generated by a paid subscription.

According to information published in the report of “TMT-Consulting”, the proceeds of Russian OTT video services amounted to RUB 3.4 billion last year. Let us remark that the company conducted its study relying on the data only from online cinemas and streaming TV broadcasting services, so the app stores information (eg, iTunes and Google Play) was omitted.

The revenues of RUB 2 billion were obtained by online cinemas from advertising, and RUB 1.4 billion from users (subscription fee and pay per view). Against 2014, the proceeds from a paid model increased by 52%, from advertising by 20%. We should put a special focus on the considerably increased income from paid services: up to 41% in the past year, whereas that figure was 36% in 2014.

The “TMT-Consulting” believes that this increase in revenue from subscriber payments could be due to two factors: the movieland’s novelties offered by online cinemas, and increasing number of acquired Smart TV-sets with already installed applications.

The “TMT-Consulting” believes that this increase in revenue from subscriber payments could be due to two factors: the movieland’s novelties offered by online cinemas, and increasing number of acquired Smart TV-sets with already installed applications.

Most of the subscribers, as before, prefer making one-time purchases: 35% in TVoD and 40% in EST. But at the same time, there observed a stable growth in the SVOD segment, as it accounts for a quarter of revenues of all the analyzed online cinemas. The leading position in terms of proceeds from paid subscriptions was taken by the OTT video service ivi.ru, followed by another two major players like Amediateka and Okko.

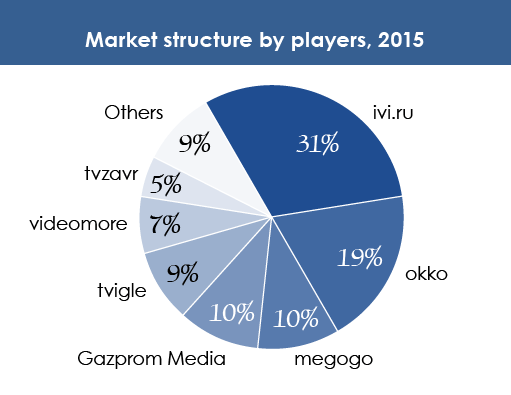

The study of “TMT-Consulting” evidences that ivi.ru is the leader not only in the SVOD segment, but also in the overall market: its share reached 31% in 2015, while in 2014 it was just 28%. Further goes the online cinema Okko in terms of revenue volume, the share of which fell, i.e from 22% in 2014 it dropped to 19%. Megogo ranks third with its figure of 10%. The results of other OTT video services are provided below.

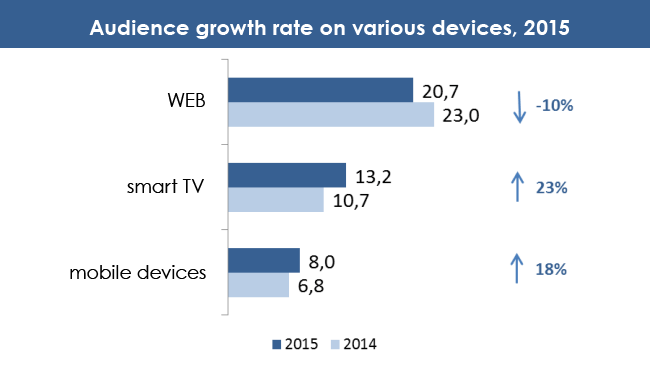

The Russian audience that prefers using legal online cinemas increased by 2.8% last year, and totalled 38.5 million people. The high growth rate was shown by the Smart TV users segment, since these devices, as already mentioned, are gaining more popularity among people. The PC audience, though still remains the greatest one, but it first started declining in 2015.

The Russian audience that prefers using legal online cinemas increased by 2.8% last year, and totalled 38.5 million people. The high growth rate was shown by the Smart TV users segment, since these devices, as already mentioned, are gaining more popularity among people. The PC audience, though still remains the greatest one, but it first started declining in 2015.

According to analysts at the “TMT Consulting”, the OTT video services market size will reach 30% and RUB 4.5 billion in 2016.

According to analysts at the “TMT Consulting”, the OTT video services market size will reach 30% and RUB 4.5 billion in 2016.