Report on the International Conference “Technologies of satellite communication and broadcasting”, which took place on October 22, 2014 during EEBC-2014.

Before we analyze the situation in the Ukrainian satellite TV market, let’s see what is going on all over the world.

Forecasts for satellite TV are rather optimistic. The number of subscribers during previous years will continue to grow as well as satellite operators’ income. However, growth will be slow because of low ARPU. According to the forecasts of Digital TV Research, the share of satellite pay-TV operators’ income in 2014 was 46%. This indicator is a turning point, this year the share of income in the segment of satellite TV exceeds that of cable one for the first time.

Digital TV Research says in its long-term prognosis about the trend towards a slow, but nevertheless increasing of the share of satellite TV during the following years. By 2020 it will increase up to 47.8%. By 2020, the number of satellite households will grow to 271 million. At the end of 2013 there were 192 million satellite households in the world, at the end of 2010 – 143 million. Growth rates will vary depending on the region. The highest growth rates are expected in India and other countries in South- East Asia. In Europe growth will be slower than in other regions.

The global trend of satellite TV growth extends to Ukraine in spite of political events there. For several reasons, the rate of growth of subscribers compared to the previous year decreased. In 2012 there were about 240,000 DTH users (according to Expert & Consulting data.) In 2013 it grew by 50% to 350,000. However in 2014 the growth rate was only 10%, reaching 382,000 users.

Over the past two years, the following changes were observed as well in pay-TV operators income: the proportion of satellite pay-TV from IIQ 2012 until IIQ 2013 increased from approximately 1.4% to just over 5%, in 2014 it has reached to 6% (YoY – 20%) .

The share of satellite TV households is 23% of households, it includes FTA.

The main reason for the slowdown in the growth of satellite TV are the events in Crimea and Donbass, and the falling of hryvna’s rate. Still DTH has some prerogatives.

- Difficulties of digitalisation will influence customers to choose DTH television. If they have to buy a digital receiver T2, it’s more advantageous to pay a little more to buy a satellite receiver and antenna to watch the much larger number of channels. Only people of limited means people who are accustomed to free social TV viewing will continue to be DVB-T2 customers.

- European experience demonstrates that the transition to digital signal increase the market share of satellite TV an average of 5-7% (according to Médiamétrie / Eurodata TV Worldwide).

- Operators with different broadcasting technologies were not equal in front of the law – there are no “must carry” channels for satellite broadcasting. So satellite providers have a prerogative in front of cable ones. However, the negotiations concerning the revision of “must carry” and improving technological neutrality have been taking months now, so it is likely that the satellite platforms will lose soon this advantage.

- In 2013 the largest media holdings announced intentions to encode their FTA channels . Now the discussion has stopped, further plans are unknown.

Precise prognoses about Ukrainian market depend on many factors, but in any case the global trend of slow growth of DTH market will affect Ukraine.

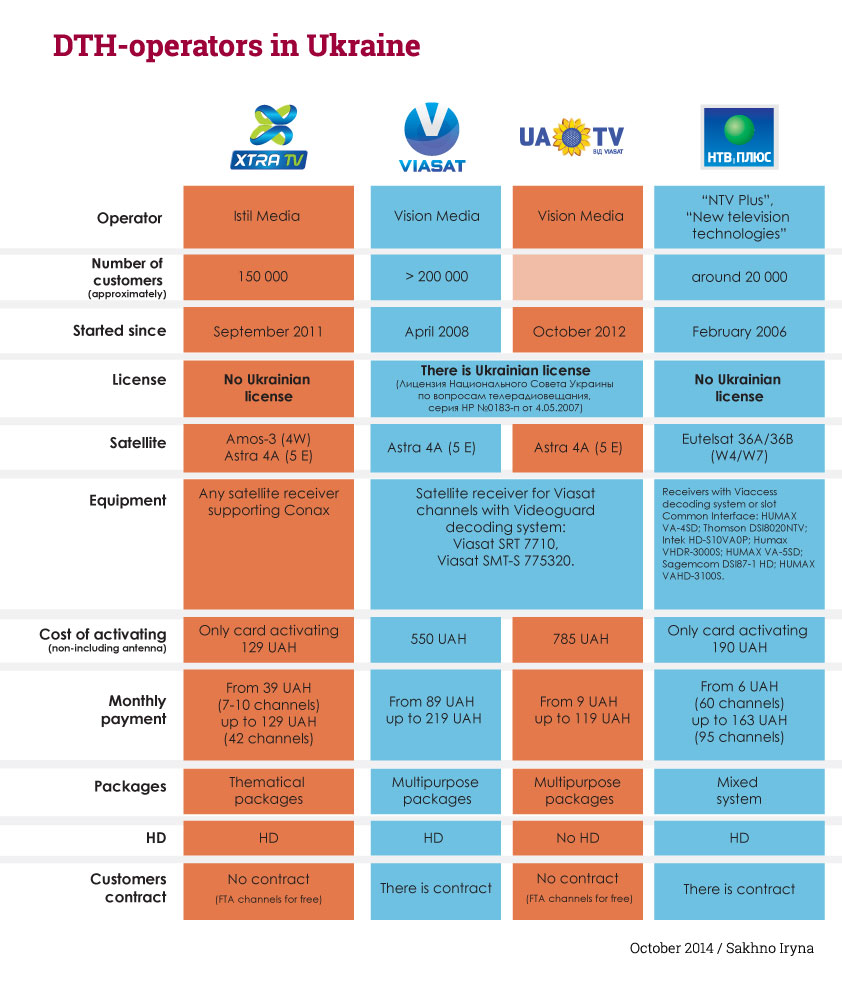

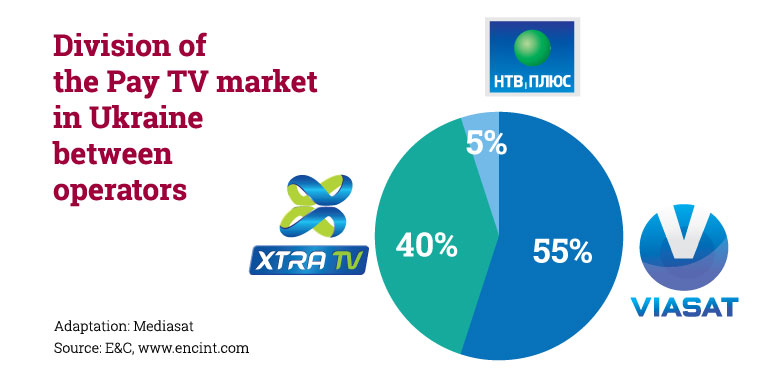

The Ukrainian DTH-market, in fact, is divided between two major operators – Viasat and ExtraTV. 5% of the market is occupied by “NTV Plus Ukraine.”

These figures are approximate, as operators are not willing to disclose their data.

Xtra TV shows the fastest subscribers growth. It is due to their successful marketing strategy. The obvious advantage for the user is the possibility to become a subscriber with their own receiver. Another is that ExtraTV began broadcasting “Football 1” and “2 Football” – the main Ukrainian football channels. As a result, we can expect further growth of subscribers ExtraTV.

This year “People operator”, as it was called because of low prices, LYBID TV ceased to exist. This shows the saturation of the market and importance of a good content. “NTV Plus Ukraine”’s story leads us to the same conclusions. A year ago, this operator, the daughter company of Russian “NTV Plus”, following its “mother”, dumped prices. Despite on the extremely low prices – 5 UAH (less then 1$) per month for 70 channels, number of subscribers diminished. Their cheap offer wasn’t popular because of the absence of many Ukrainian and other channels. In addition, “NTV Plus Ukraine” continues to suffer from piracy.

There have been no major changes in the strategy of Viasat.

Last year, the competition between the pirates and appearing of new “low cost” operators brought to cutting prices, but now services tends to be more expensive again. The cost of the cheapest package Extra TV, for example, went from 29 to 39 UAH, the card price – from 99 to 129 UAH. Viasat and “NTV Plus Ukraine” increased their prices too.