In recent years, the Telco Trends Conference in Latvia has been a platform for meetings of telecom market players from Europe and the CIS to discuss the latest news in the field of shaping Single Digital Europe, as the Mediasat regularly features.

This year, Edmunds Belskis, Deputy State Secretary in charge of information and communication technologies (Latvia), spoke about the new stages in implementation of the Digital Europe Programme. Toms Meisitis, SIA Lattelecom, Director of Legal and Corporate Support Division, drew attention to new business opportunities of a single digital market. Andris Mellakauls, Head of Information Space Integration Division of the Ministry of Culture of Latvia, highlighted the upcoming regulatory initiatives, implemented within the Single Digital Europe Programme.

Jerzy Straszewski, President of the Polish Chamber for Electronic Communication (PIKE), spoke about Poland’s progress in the framework of the above Programme. The participants spoke a lot about the important role of online platforms in implementing the Single Digital Europe Programme, plans for partial geo-blocking, bringing advertising and other legislation to a common standard.

A piracy session turned out very interesting and efficient. At the previous Telco Trends Conference, Dace Kotzeva, Executive Director of the Association “For Legal Content”, spoke about the popularity of piracy in Latvia: at least 97 thousand subscribers (there were totally 480 thousand pay-TV subscribers in 2016) paid pirates. Because of this, the government and legal operators lost some 120 euros per subscriber annually. Mrs. Kotzeva promised to intensify fighting illegal content and, judging by the results of this year, she delivered on her promise. Since February 2017, the piracy level has decreased by 20%. The Mediasat reported on the results of that anti-piracy campaign. At the conference, Mrs. Kotzeva shared new details. During six months, the police inspected some 20 operators, it blocked a pirate resource with 50,000 users in January 2017, it initiated 8 criminal proceedings and uncovered a criminal organization, etc.

Ross Biggam, VP Government Affairs at Discovery Communications, pointed out that the role of content in the TV business was growing, so that it was possible to observe important positive trends like the cooperation between IPTV operators, including the global one, the improvement of legislation and operation of courts.

Christopher Elkins, Chief Strategy Officer at MUSO (United Kingdom), presented the results of piracy research in the Baltic States. They are among the leaders in terms of requests for pirate sites.

From 60% of users of pirate resources in Latvia and up to 80% in Lithuania watch them online, 16% (Lithuania) and 38% (Latvia) use torrents, and the downloads account for several percent.

Alexey Byrdin, CEO of the Association Internet-video, shared the anti-piracy experience in Russia. According to him, 155 lawsuits were filed against video pirates by Gazprom-Media (104), Warner Bros. (27), Bazelevs (13), while Disney, Sony, 20th Century FOX, Paramount, Universal, Viacom, Discovery, VGTRK did not bring any court action against pirates at all.

In 2017, four new laws were adopted to rule the piracy situation in Russia:

“Mirror Sites Law. If the original domain is blocked judicially, its copies (mirrors) are subject to extrajudicial blocking upon the resolution of the Ministry of Communications and the Media. All blocked sites shall be removed from the search engine results.

Audiovisual Services Law. The requirements for online cinemas, which pirates are not able to meet: de-anonymization, marking, other restrictions.

VPN Restrictions Law. The requirements for VPN services not to provide access to those sites blocked in the Russian Federation.

Instant Messengers Law. The mandatory authorization via phone number (de-anonymization)”.

The following ideas and initiatives are under discussion within the market community and at the national level:

– Social media operators’ responsibility for the content posted on social media.

-Restricted distribution of desktop and mobile pirated apps.

– Extrajudicial blocking of sites with pirated copies of “domestic films”.

– Penalties for users downloading pirated content.

Mr. Byrdin believes that it is required to fight pirates using all available tools: administrative and legislative measures, technologies (monitoring playback on devices, monitoring downloads, removing apps), banned advertising on pirate resources (the bulk of piracy income), blocking money orders. Nils-Filip Abrahamsson, SES Business Development Manager in Nordics, Baltics and Eastern Europe, told about the recent changes on the Ultra HD market: “Just a couple of years back, we started speaking about Ultra HD during presentations, although it was still too early. Today, only two years later, SES broadcasts 32 UHD channels. SES launched the first channel in September 2015, so we can state that the growth of 4K channels is quite rapid”.

While there were 26 Ultra HD channels in the world in 2015, and 51 channels in early 2016, so today there are 75 Ultra HD channels. In less than two years, their number has increased by 108%.

Mr. Abrahamsson emphasized that the operator SES has always paid great attention to the development of the above standard. It was the satellite SES Astra 19.2°E that was chosen by the first European commercial Ultra HD channel Pearl.tv, which broadcasts free-to-air. SES satellites broadcast 32 Ultra HD channels; therefore, the growth rate of 4K channels on SES satellites is higher than the world average of 183% in less than two years.

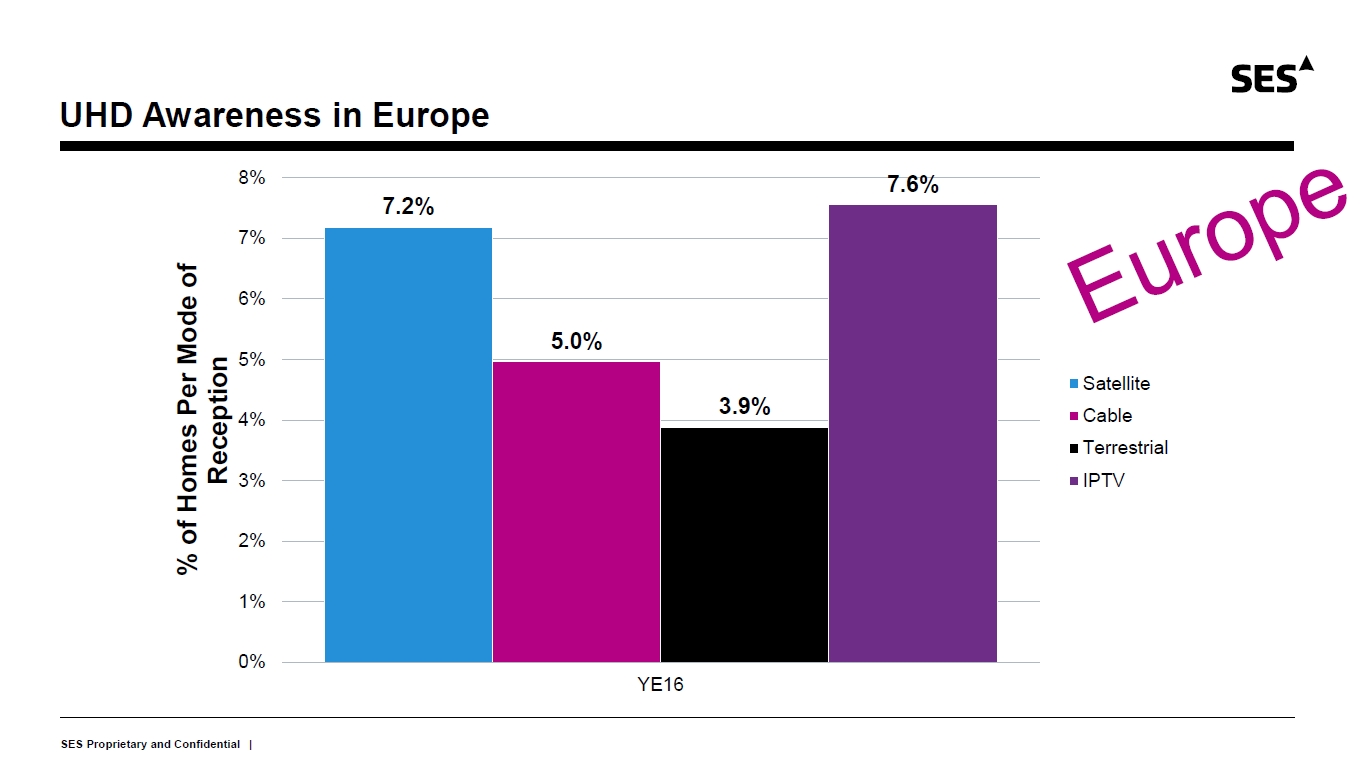

The driver of 4K growth is a UHD TV-set sales boom due to slumping prices, and there appear more and more 4K set-top boxes. In 2017, the major TV manufacturers LG, Panasonic, Sony, and JVC announced the support of the Hybrid Log Gamma standard. Pay-TV operators are increasingly relying on the premium model with 4K channels included. According to researches, users are more aware of the new standard. As a rule, the 4K awareness ratio is higher among users of IPTV and satellite TV. “Ultra HD television sets is getting more affordable and in the same time larger sizes becoming more popular which requiring higher resolution and also according to our latest satellite monitor results the awareness of Ultra HD in Baltics is higher compared to the rest of Europe ”, as Mr. Abrahamsson says.

The factors crippling 4K development are as follows: content is still lacking, most operators are not prepared technically to broadcast Ultra HD, and users are in no haste to buy new TV-sets until the old ones fail.

However, Mr. Abrahamsson is confident that Ultra HD is the thing of the future. According to estimates, 43% of TV sales will refer to the 4K segment by 2019.

Karen Badalov, Regional Director, Baltic States & Caucuses at Eutelsat, also focused on the rapid Ultra HD development. There are expected 200 UHD channels by 2020, and 1000 ones by 2025. According to estimates, all sold TV-sets and set-top boxes will meet the 4K standard by 2025. Mr. Badalov informed about the Eutelsat Maritime solution, satellite communication for ships. The speaker also recalled the advantages of combined platforms (satellite + Internet) against other platforms. A traditional platform cannot ensure coverage of the entire population without quality losses. Eutelsat offers the Smartbeam solution. TV channels and content on demand in IP are received in multicast mode. TV channels in IP format are distributed to mobile devices via WiFi access points. The terrestrial return link (DSL/3G) allows to collect precise audience statistics and to exchange DRM keys for protected content.

Guy Bisson, Executive of analytics company Ampere Analysis, offered advice on the OTT business development, to be featured in detail in a separate article.

Dmitry Kolesov, Director of the Department of TV and Content J’son & Partners Consulting, presented an analysis of international experience in increasing ARPU. Almost half of the revenue, 49%, operators get from basic packages, 33% from additional packages, 15% from the extended ones, while a la carte accounts for only 3%. Little wonder that the latter is not very popular with providers.

Revenue structure of operators by packages, 2016

| Basic package | 49% | Analyzed Pay-TV markets:

|

| Additional thematic packages | 33% | |

| Extended package | 15% | |

| A la carte | 3% | |

After analyzing the markets of the United Kingdom and Germany, Mr. Kolesov came to the following conclusions. When making an offer, it is necessary to take into account the market situation. The influence of terrestrial TV and the market shares of technologies. The behavior of the largest player, which is perfectly evident from the Sky case (UK), occupying 2/3 of the market and significantly affecting the ground rules. It is important the demand of different social groups (migrants, expat communities, children) for certain content; for example, in Germany, migrants make 21% of the population, so there is a high demand for foreign channels. Among the general trends, it should be taken into account the growth in demand for VOD and multiscreen.

United Kingdom: Pay-TV subscriber base

| Pay-TV Penetration Rate (62% – 17.2 million households) | ||

|

64% 22% 14% |

Satellite Cable IPTV |

|

Revenue structure of operators by packages

| United Kingdom | 41% | |

| 8 countries on average | 33% | |

|

Basic package Additional thematic packages |

Extended package A la carte |

Revenue performance 2016/2015, %

| Total revenue of operators from TV services | 8% |

TV ARPU – 2016: 31.5 euro |

| Basic package | 7% | |

| Extended package | 23% | |

| Additional thematic packages | 5% | |

| A la carte | -2% | |

| VOD | 12% | |

Germany: Pay-TV subscriber base

| Pay-TV Penetration Rate (94% – 36.6 million households) | |||

|

46% 7% 48 |

38%9% |

Cable TV IPTV Satellite free-TV Satellite pay-TV |

|

Revenue structure of operators by packages

| Germany | 70% | 7% | |

| 8 countries on average | 49% | 3% | |

|

Basic package Additional thematic packages |

Extended package A la carte |

||

Revenue performance 2016/2015, %

| Total revenue of operators from TV services | 5% |

TV ARPU – 2016: 19.9 euro |

| Basic package | 3% | |

| Extended package | 13% | |

| Additional thematic packages | 8% | |

| A la carte | 9% | |

| VOD | 28% | |

As in the previous years, the conference was accompanied by pleasant and smart events. An indispensable attribute and pearl of Telco Trends was the traditional SES party on the Baltic Sea beach in the legendary restaurant in Jurmala. Nils Filip Abrahamsson shared his partnership impressions: “We opt for the partnership with Telco Trends because we like the international approach of the event. We are glad to meet here with our partners and clients. Telco Trends is a venue for sharing knowledge about the market and current trends.