The Ukrainian pay satellite TV market does not let its players or journalists get bored. Despite the fall in figures, here come new players like the company Eutelsat. The operator was also present in Ukraine before (some Russian channels broadcast via the satellite Eutelsat 36B), but it did not carry out an active policy. Over the last year, the owners of pay satellite TV platforms changed: the Media Group Ukraine acquired Xtra TV, and 1+1 Media is actually about to buy Viasat Ukraine.

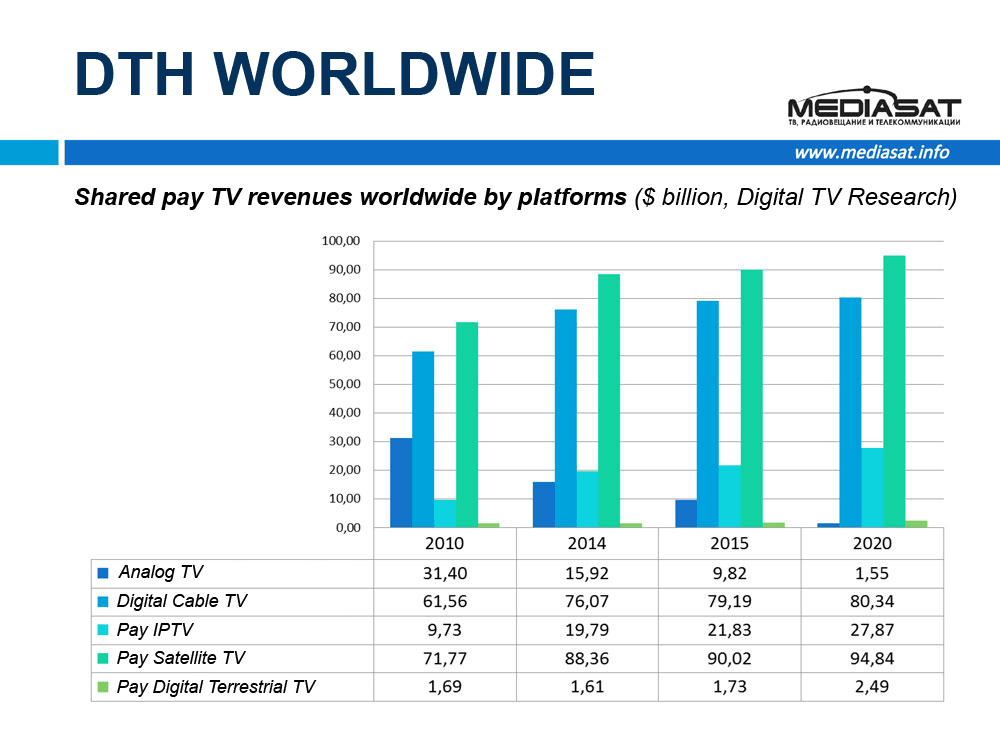

At the same time, the world keeps on quiet. As in previous years, there is a slow steady growth of satellite TV figures. According to research by the Digital TV Research, the forecasts for satellite TV are optimistic, especially taking into consideration that revenue growth of pay TV in general, and the satellite one in particular, slow down (given increasing number of subscribers) due to declining ARPU. In 2014, the satellite TV share in the pay TV operators’ revenues was 46%. The same year, the share of revenues in the satellite TV segment first exceeded the share of revenues in the cable TV one. And in 2020, it is expected the revenue growth of the satellite segment up to USD 94.84 million. In 2020, the number of satellite households will grow to 271 million (192 million in late 2013, and 143 million in late 2010).

The growth of the key figures is due to the Asian markets. In Europe, the growth will be slower.

The Ukrainian satellite TV market has a series of features. Prior to 2015 in Ukraine, as worldwide, there was a slow steady growth of the segment. According to the Expert & Consulting, in 2012 there were near 240 thousand users, in 2013 there were 350 thousand, and in 2014 there were 382 thousand. In 2014, the subscriber growth rate fell against the previous year. In 2015, in view of political events, loss of subscribers in the Crimea and Eastern Ukraine, as well as the dissolution of the satellite platform Lybid TV and changed owner of Xtra TV, the number of subscribers dropped to 190 thousand. During the year, it is observed a negative dynamics of over 40%.

The Ukrainian satellite TV market has a series of features. Prior to 2015 in Ukraine, as worldwide, there was a slow steady growth of the segment. According to the Expert & Consulting, in 2012 there were near 240 thousand users, in 2013 there were 350 thousand, and in 2014 there were 382 thousand. In 2014, the subscriber growth rate fell against the previous year. In 2015, in view of political events, loss of subscribers in the Crimea and Eastern Ukraine, as well as the dissolution of the satellite platform Lybid TV and changed owner of Xtra TV, the number of subscribers dropped to 190 thousand. During the year, it is observed a negative dynamics of over 40%.

Similar changes concerned revenues: the share of pay satellite TV from the second quarter of 2012 to the second quarter of 2013 increased by approximately 1.4% amounting to 5%. In 2014, it reached 6% (annual dynamics was 20%). And in 2015, the share decreased by about 2%.

The revenue growth is proportional to increasing number of subscribers (slightly less than by half), and respectively it is not due to the ARPU growth, i.e. this trend was observed up to 2015.

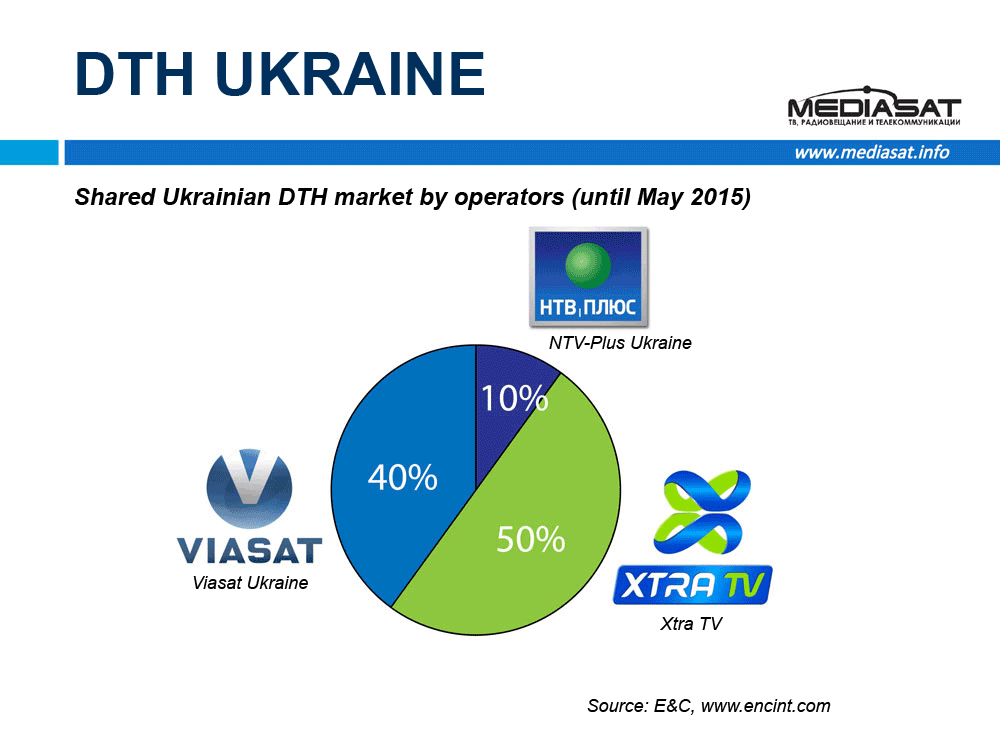

Many have tried to do a profitable business in the Ukrainian satellite market: NTV Plus Ukraine has been operating since 2005, Poverkhnost TV in April 2008 – 2010, Viasat Ukraine since April 2008, Digital Fly Ukraine (MyTV) in 2009 – December 2010, Xtra TV in September 2011 – May 2015 (then getting a new owner and restart). The last one showed the fastest rate of subscriber base growth and effective marketing policy without reference to the equipment. Now, the main trump card of the platform is its exclusive broadcasting of the channels like Football 1 and Football 2.

Many have tried to do a profitable business in the Ukrainian satellite market: NTV Plus Ukraine has been operating since 2005, Poverkhnost TV in April 2008 – 2010, Viasat Ukraine since April 2008, Digital Fly Ukraine (MyTV) in 2009 – December 2010, Xtra TV in September 2011 – May 2015 (then getting a new owner and restart). The last one showed the fastest rate of subscriber base growth and effective marketing policy without reference to the equipment. Now, the main trump card of the platform is its exclusive broadcasting of the channels like Football 1 and Football 2.

Platforms used different models, but they worked inefficiently, i.e the platforms either closed down, or were not so profitable. Marketing experts tried to play with prices. For example, NTV Plus Ukraine set a record low price of UAH 5 per month, but even that tool did not help to attract subscribers.

The low-cost strategy was also applied by another operator Lybid TV, which existed from 2012 to April 2014. The platform held itself out as a “national operator”, offering few channels for a minimum price.

Over recent years the market is virtually shared by two operators Xtra TV and Viasat. Against previous years the market share of NTV-Plus Ukraine increased from 5% to 10%. This is not due to the increasing number of NTV-Plus’ subscribers, but to the competitors’ customer outflow.

According to rough estimates of the Expert & Consulting, the dynamics of the number of pay satellite platforms’ subscribers is as follows:

According to rough estimates of the Expert & Consulting, the dynamics of the number of pay satellite platforms’ subscribers is as follows:

- NTV-Plus Ukraine holds relatively steady: 15-20 thousand subscribers;

- Viasat Ukraine in 2014: 110 thousand, and in late 2015: 50 thousand subscribers;

- Xtra TV: the number of subscribers fell to 60-70 thousand at the end of 2015, while there were about 115 thousand of them in 2014.

When different business models do not work on the market, so it is not about just them, but it is also about an unfavorable market situation. At first glance, the circumstances discourage an effective satellite TV business. However, there are encouraging factors as well. An important market growth is possible due to FTA viewers and users of pirate resources, which is a niche of consumers able to become a monetization source. The required condition for this is to encode free-to-air broadcasting channels. In 2013, the media groups announced their eagerness to encode FTA, but they have not so advanced in it. The need to comply with information security, in turn, does not promote to give up encoding.

Operators applying different broadcasting technologies are not equal in front of the law: General Content Service (UPU) does not apply to the satellite broadcasting, on the one hand, and thus the difficulties of cable operators are convenient to the satellite ones. On the other hand, UPU removal, remaining under discussion for a long time, will allow encoding most channels, and will facilitate the development of pay TV in general.

Digitalization of terrestrial TV will facilitate the growth of the satellite one, as many viewers instead of buying digital receivers would prefer spending a bit more money on satellite reception sets. The terrestrial TV audience will remain represented just by insolvent people accustomed to free TV viewing. This is evidenced by the European experience, i.e. while transiting to the “digital” there increased a share of satellite signal reception by an average of 5-7%, according to Médiamétrie / Eurodata TV Worldwide.

The main and permanent obstacle to pay TV, its “chronic disease” and constant background remains piracy, people insolvency, falling hryvnia, etc. In this context, the market players (or intending ones) face a task to make the best use of favorable factors and thoroughly analyze the business model of their satellite TV platform.