Adopted from «PayTV in Ukraine» conference with Eutelsat support.

The situation in the pay-TV market in Ukraine is not easy now. Underreporting the number of subscribers, the regressive legislation, illegal tax optimization schemes used by some operators, avoiding licensing and other violations of the law are among the topical issues. But is Ukraine so unique with their problems? Apostolos Triantafillou, the Vice President on sales in EUTELSAT satellite operator, believes that Ukraine does not fundamentally differ from other countries. And now it is the right time to pay attention to the neighbors’ experience to solve these problems using proven methods. With this purpose, EUTELSAT that was a partner of KIEV MEDIA WEEK invited the Serbian company SBB – one of the key EUTELSAT partners in Eastern Europe – to PayTV in Ukraine 2016 conference. The case of Victoriya Boklag, the Vice President of marketing and media in United Group and CEO in SBB, is dedicated to the success story of the company which became pay-TV operator No.1 in the Balkans within 15 years.

Now, when pay-TV and video content can be watched on a huge number of platforms, including mobile phones and tablets, the companies operating in the telecommunications sector use different strategic approaches for the development of their business to increase ARPU and not go “overboard”. Based on the chosen strategy, telecommunication operators can be divided into three categories:

- The operators that are constantly trying to strengthen their position in the previously occupied niche (e.g., consolidation, takeover smaller competitors), but do not go into other market segments.

- The operators that go to other niche not having solidity yet in their main field of activities (regular introduction of a new services and their packaging).

- The operators trying to take new niche when they become stable in their main activities (parallel consolidation and new services introduction).

It’s not surprising, that those ones who were just the internet service providers before are launching IPTV services or even their own TV or web channels (e.g. YouTube) now. Looking at the Ukrainian market, you will find representatives of all three categories. Add the economic difficulties, lack of transparency in the provision of data on the subscribers number (underreporting), as well as the confusion with regulators and TV channels to that – and you will get a complete chaos. Actually, this is what we have in the Ukrainian market today.

And now remember Yugoslavia 15 years ago. It was about the same: problems who and what regulates, who sells to whom (if not “piracy”) and for how much, and why they are paying this price. Let alone the regulated pay-TV market.

Look at the former Yugoslavia territory now – Serbia Broadband (SBB) cable operator has worked here for fifteen years. All this time they have been developing despite all the difficulties, and now it is not only the largest telecommunications group in the territory of the Balkan Peninsula, but also one of the largest operators in the Central and Eastern Europe. We will not claim that the above mentioned first or the third option for the operator’s development is always winning. We need to try and time is the best indicator. But, in most cases, a gradual and consistent penetration to new niches when the basic one is already firmly occupied is better and more successful than “everywhere, but a little bit” strategy. The case of Serbian SBB presented at Pay TV in Ukraine 2016: Up&Up conference within the framework of the VIth KIEV MEDIA WEEK annual forum is about this. We hope that this will be a good lesson for our domestic operators.

So, let us tell what Victoriya Boklag, the vice-president of marketing and media in United Group and CEO in SBB, was talking about.

ACHIEVEMENTS

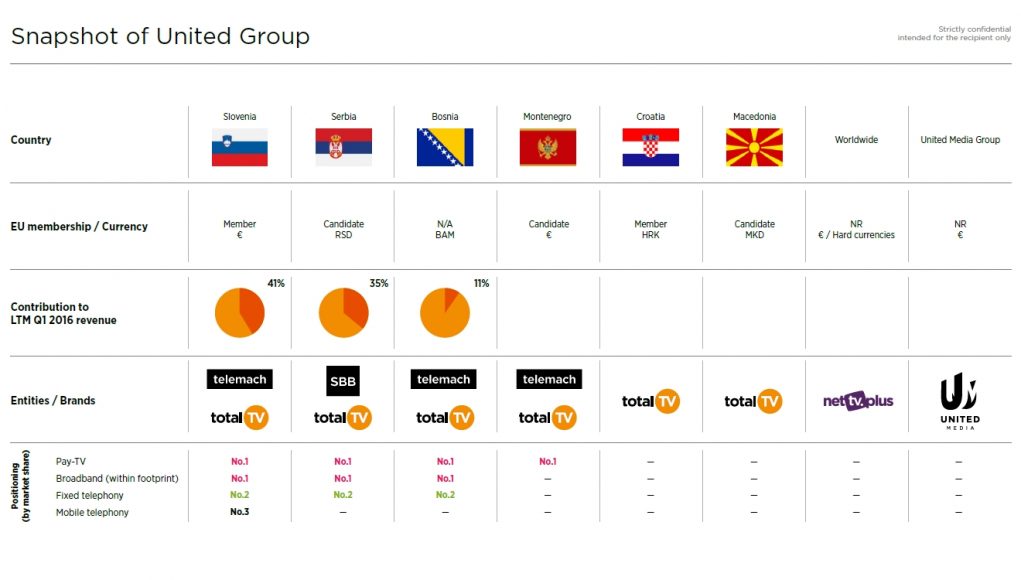

SBB started in 2002. Then they worked on the territory of Serbia only as a cable pay-TV operator. Now this company works at the markets of Serbia, Slovenia, Croatia, Macedonia, Montenegro and Bosnia. And it is involved in content distribution using almost all existing delivery platforms – OTT, catch-up TV, TVoD etc. And this is right: the technologies must be relevant, it is impossible to provide pay-TV via analog TV, for example.

The operator works in two directions: content production and distribution as well as TV-platforms management.

With regards to the first, SBB launched their own programs production in 2012. All of them are part of fifteen operator’s TV channels. This is content produced in the region and for the region’s inhabitants. This reminds the Ukrainian situation where the Russian content is prohibited, doesn’t it?

Sports content is actively purchased – NBA, Formula 1, the rights for championships in football and tennis. Children’s programs, movies are imported but less. Two years ago, the operator has invested in news channels and the largest music production in the territory of the Balkans.

The second direction, as it was mentioned above, is the platforms management. In 2006, SBB launched Total TV satellite service, and in 2012 – NetTV Plus OTT service. The operator works under SBB brand on Serbian cable TV market, under Telemach brand on Slovenia and Bosnia cable TV market and Montenegro soon – the rebranding of the bought assets last year is under way. Total TV is available in all six countries – in Serbia, Slovenia, Croatia, Macedonia, Montenegro and Bosnia.

Due to this, currently SBB is pay TV-operator No.1 in Serbia, Bosnia and Montenegro, and among the top three in Croatia and Macedonia (it physically can not be the first due to the lack of cable infrastructure but the situation may change). If talking about broadband access, SBB is No.2 in Serbia, and that is because it has not as big infrastructure as the country is, in contrast to several other operators in the country. The number of pay TV subscribers is approaching the level of 1.2-1.3 million, while RGU is almost 3 million. ARPU continues to grow.

But what they had to go through to achieve such a result?

PIRACY

When SBB was just a startup, piracy flourished in Serbia. The operators’ packages included Discovery network’s channels, popular Eurosport etc. And all this – 70 popular channels, movies and TV programs – was included in the package of 1 Euro cost. Yes, the rate of pay-TV penetration was just 10 %. But nevertheless, no one was afraid of nothing … Until in 2003-2004 there was adopted the law on criminalizing piracy with up to 8 years of imprisonment.

Then the operators were afraid, because, of course, the heads of TV channels and cable operators did not want to go to jail. The conclusion was logic – SBB decided to legalize. The operator’s representatives started negotiating with the largest content providers and TV channels distributors, it was agreed that they would buy content basing on the subscribers number. But with a condition that the price is the same for all – not to sell content to competitors for cheaper price.

And no pirate channels remained in the country within 3-4 months. The content value began to grow, and SBB had an opportunity to earn and to add new channels, thus increasing the packages cost. In the end, the price of the pay-TV cable operator’s basic package has reached the level of EUR 10.

It is important to say that SBB originally proposed minimum package for the price of EUR 6, and if the subscribers did not leave within three months, they were switched to the basic package of EUR 10. At present, 95 % of SBB pay-TV subscribers pay right EUR 10.

BALANCE OF SERVICES

The SBB heads also believe that Internet is likely to become the main platform for TV content delivery. But this will be in the future. Now someone is not ready to pay and watch TV via the Internet, and others just can not do it physically. For example, Victoria said, there are about 20 million TV-households in the territory of the six countries where the SBB works. And not everyone has broadband Internet access. But cable laying is expensive and not profitable. So, satellite TV is a nice alternative.

The one thing is to be able to run OTT everywhere. But necessity in OTT for all is another issue. Because it is important that services complemented each other and were not dependent on each other to a considerable extent. So, other more relevant services should be developed and that’s no need go blindly for future technologies.

BUNDLING

When the service is new, it is obviously difficult to sell. But if the service is included in the package together with the service that has already become a necessary, reliable and proven, then the most of subscribers are ready to try it. And SBB is one of the operators using services bundling that is so popular today.

Total TV service includes pay-TV together with the Internet access and telephony. And a separate package of channels is developed for each country where this service works. The heads of some Ukrainian media groups believe that the Ukrainian consumer is willing to watch everything, and sometimes does not know what he wants until they give it to him. Simply stated, an average Ukrainian is ready to look everything he is offered. And certainly many “average Ukrainians” are not agree with this. Consumer needs are also important. Content should not be imposed but it should be really interesting to the consumer.

PAY TV AND DTT

When the switch from analogue to digital terrestrial TV in Serbia began, SBB made all the efforts to promote their Total TV satellite service. After all, people were at a crossroads – to buy DTT-receiver or set-top box to view DTH.

SBB did not open kiosks. They did not initiate a large-scale advertising campaign. The company began to cooperate with small firms engaged in TVs repair, air conditioners installing, etc. So, they were using word of mouth effect. And now this operator’s “dealer network” is about 1 thousand people who are not SBB employees.

Why Ukrainian operators do not risk to go to the satellite when it is cheaper – infrastructure costs are minimized, but they go into the content purchase and production and the transponders lease segment – when there is still a mess in the field of terrestrial TV?

VOLATILE CURRENCY

Dependence on foreign currencies plays the important role, in case of Ukraine this is USD. But situation in other countries is the same. And SBB also faced that problem, since it began to work after the war ended in Yugoslavia.

How the operator minimized that risk? SBB paid attention to the markets of neighboring countries where the situation was more stable than in Serbia. The risks were considerably reduced after the territorial business diversification (as we mentioned, SBB is currently working on the markets of Slovenia, Macedonia, Croatia, Montenegro and Bosnia and Herzegovina). So, their income was increasingly becoming well-supported by a “feeling good” Euro on which the Serbian currency was dependent.

But the EU is not so far from Ukraine, as it may seem. And Ukrainian content (such as TV formats) continues to conquer foreign markets. By the way, part of them is located much further.

SEARCHING FOR THE STRATEGIC PARTNER

It is important to note that during the entire period of SBB activity Eutelsat operator provided them with the satellite capacity.

There were several reasons for this: more favorable conditions for the transponders lease; broadcasting other popular channels from the satellite set in the same or adjacent position; possibility of coverage extending to other adjacent countries using the same satellite. In simple words, when going out to the satellite TV channels and operators should calculate an option of geographical expanding in advance, and also which channels are already available for country viewers using this or a neighboring satellite. Who benefits on reconfigure the antennas if he can use already installed ones or add another LNB?

IS UKRAINE ONE OF ITS KIND?

For many years, there are disputes: is it worth to focus on foreign experience or Ukraine is unique? At the same time, overseas studies are continuously taken into account, conventions and agreements are signed. And as a result, the reforms are not implemented, or are carried out, but not as it was expected, in quite different way. “In our way”.

And, nevertheless, Victoriya Boklag, and Apostolos Triantafillou, the Vice President on sales in Eutelsat, are confident that Ukraine fundamentally is not different from other countries. Issues are the same. So, why the solutions should be radically different?

Here are applicable the words of Ivan Shestakov, marketing director in Megogo, who said on the same conference that there is an impression that the purpose of the Ukrainian business is not to earn as much as possible, but not to allow a competitor to earn. It is time to give up this “model” and make some real steps.