Telco Trends conference in Latvia has been a platform for meetings of telecom industry representatives from Europe and the CIS countries for many years. Mediasat wrote before about the program of the Single Digital Europe. This year, participants of the conference discussed the latest results of the work on this project.

Belskis Edmunds, Deputy State Secretary Information and Communication Technologies Division in Latvia, told about the importance of online platforms in the implementation of the Single Digital Europe program and about the plans for a partial cancellation of geoblocking.

Jerzy Strashevski, the President of the Polish Chamber of Electronic Communications, informed about the achievements of Poland in the program. 76 % of households have internet access, optical networks coverage increased by 21 %, investments in telecom also increased. The European Fund has allocated EUR 2 billion 172.5 million on the program (2014 – 2020), EUR 394.4 million were allocated by Polish side. Mr. Strashevski noted that the digital single market will provide more opportunities for broadcasters and, accordingly, the revenue, but it will require more responsibility from online platforms.

Vaiva Zhukiene, the President of the Lithuanian Cable Television Association, told about the latest trends in the market. It immediately struck that the share of satellite pay-TV decreased by 10 % over the last year, while the global satellite TV shows stable growth. Ms. Zhukiene suggested in the commentary for Mediasat that this is due to the widespread penetration of the Internet and cable TV and a small teritory of the country. Indeed, IPTV grew by 21 %, and digital cable TV by 6.4 %.

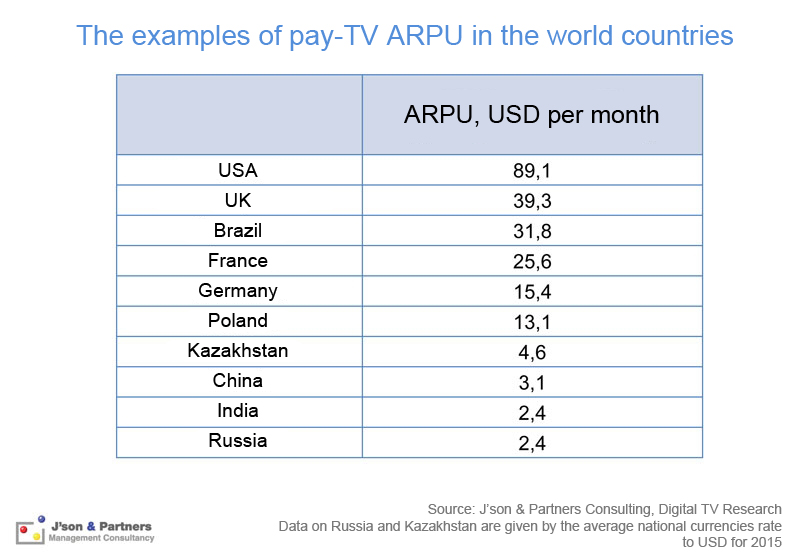

Dmitry Kolesov, the Director of the TV and content Department in J’son & Partners Consulting, told about global Pay-TV trends.

The growth of mobile devices and time of mobile video viewing significantly changes the environment, but it is not a threat to pay-TV. Presence of OTT services is a necessary condition for the success of any platform. Non-operators OTT platforms are popular primarily in high-ARPU markets.

Nils Philip Abrahamsson, the representative of SES satellite operator, reported about the global trends of Ultra HD. He payed attention that the linear TV remained the most popular platform while there are increasing content view in the high quality and growing of OTT-services (according to forecasts for 2015-2019, HD-TV viewing will increase by 75 %).

There are 51 Ultra HD channels globally. 26 Ultra HD channels are broadcasted from SES satellites, 16 of them are commercial. The new standard has become a reality and made an evident impact on global TV ecosystem. TV channels are not distributed evenly: commercial UHD broadcasting is already present in Europe and Asia but in Africa 4K is almost absent. Rapid increase in sales of UHD TV-sets is a driver: sales increase by 42.55 % in 2016-2017 in Western Europe is expected, reaching 12 million bought 4K TV sets. The price for the TV sets with a medium-sized screen is relatively low – USD 700-800 for such brands as LG and Samsung. The amount of available 4K content lag behind from the production of viewing devices, but major US studios, South Korea and Japan are actively filming in Ultra HD, creating 4K-content library for sale in other regions.

“Fashion One 4K, the first UHD channel, began broadcasting from SES satellite” – reminded Mr. Abrahamsson. TV channels mostly consider 4K broadcasting as part of the marketing strategy for brand awareness and ARPU increase now; NSR analysts suggest that their commercialization will begin in 2020, and the platform that will manage to attract the audience of UHD content will receive long-term dividends as a pioneer. But now UHD broadcasts are not commercially profitable because of the high cost.

“Perhaps, MTG company in partnership with SES will become “the first engine” for 4K” – Mr. Abrahamsson suggests. MTG launches first sports 4K TV channel in the Scandinavian countries, and there is reason to believe that the company will continue to develop this area.

Karen Badalov, the Regional Representative of Eutelsat satellite operator, told about the benefits of the combined platforms (satellite + internet) as compared to conventional OTT platforms. Traditional OTT platform can not provide coverage of the entire population without loss of quality. Internet channel may suffer from congestion in the “rush hours”, adaptive transmission rate converts HD content to SD. The costs for delivery networks grow with the audience, but the satellite communication allows to avoid this. Eutelsat offers the Smartbeam solution. TV channels and content are received from IP on-demand in multicast mode.TV channels in IP format are distributed to mobile devices via a WiFi access point. Ground return channel (DSL/3G) allows to collect statistical information about the audience and share DRM keys in the case of protected content.

Russian channels proscription and its effect on the markets of Latvia, Lithuania and Ukraine was the subject of a separate panel discussion (report by Iryna Sakhno, Mediasat, on the situation in Ukraine is available here). Martins Traubergs, the Director of TNS Latvia, told about the preferences of audience and their changes. The participants agreed that protection of the national interest is necessary, and it should not infringe the right of viewers to receive information, but it did not become possible yet to determine exactly where this “golden mean” goes.

Participants discussed the traditional topic of piracy. Dace Kotzeva, the Executive Director of the society “No piracy in Latvia”, said that according to the information of the Statistical Bureau of Latvia, in the country there are more than 800 thousand households, about 88 % of them are pay-TV subscribers. 480 thousand of them are the subscribers of the major operators (Lattelekom, Baltkom, Viasat), 130 thousand use the services of other operators, and at least 97 thousand pay to the pirates. Because of this, the state and the legal operators lose about EUR 120 per subscriber a year, not mentioning taxes, informal economy, etc. The organization “No piracy in Latvia” primarily serves as the coordinator of efforts and works in cooperation with the Latvian and European regulators, cooperates with Youtube and Google. “We focus on “yes” rather than” against”, let us not fight against piracy but first and foremost but to protect the pirated content” – Ms. Kotzeva says. George Barzashvili, the General Director of “Digital Screens”, Ukraine, is in more bellicose mood and calls to fight with the pirates in all aspects: prevention, judicial proceedings, advertising restrictions, legislation lobbying… Here are the results of Digital Screens fight against piracy for the last year:

- 66 applications, 35 legal proceedings, 10 searches, 3 criminal cases;

- 200K references and 50K links are removed from the search;

- 14 legal proceedings against domain owners/sites;

- effectiveness of the protection rose to 83 %;

- constant service providers, websites, OTT platforms monitoring.

“Everybody has to do it!” – says George Barzashvili.

******

As usual, a lot of interesting things happened outside of meeting rooms: meetings, business communication transforming to unofficial, and vice versa. This year, guests were lucky to see the launch of the satellite… At the long-awaited and already traditional party organized by the SES, without which Telco Trends is hard to imagine, the rocket (well, almost real one) was launched into space from the pad on the bank of the Baltic Sea.